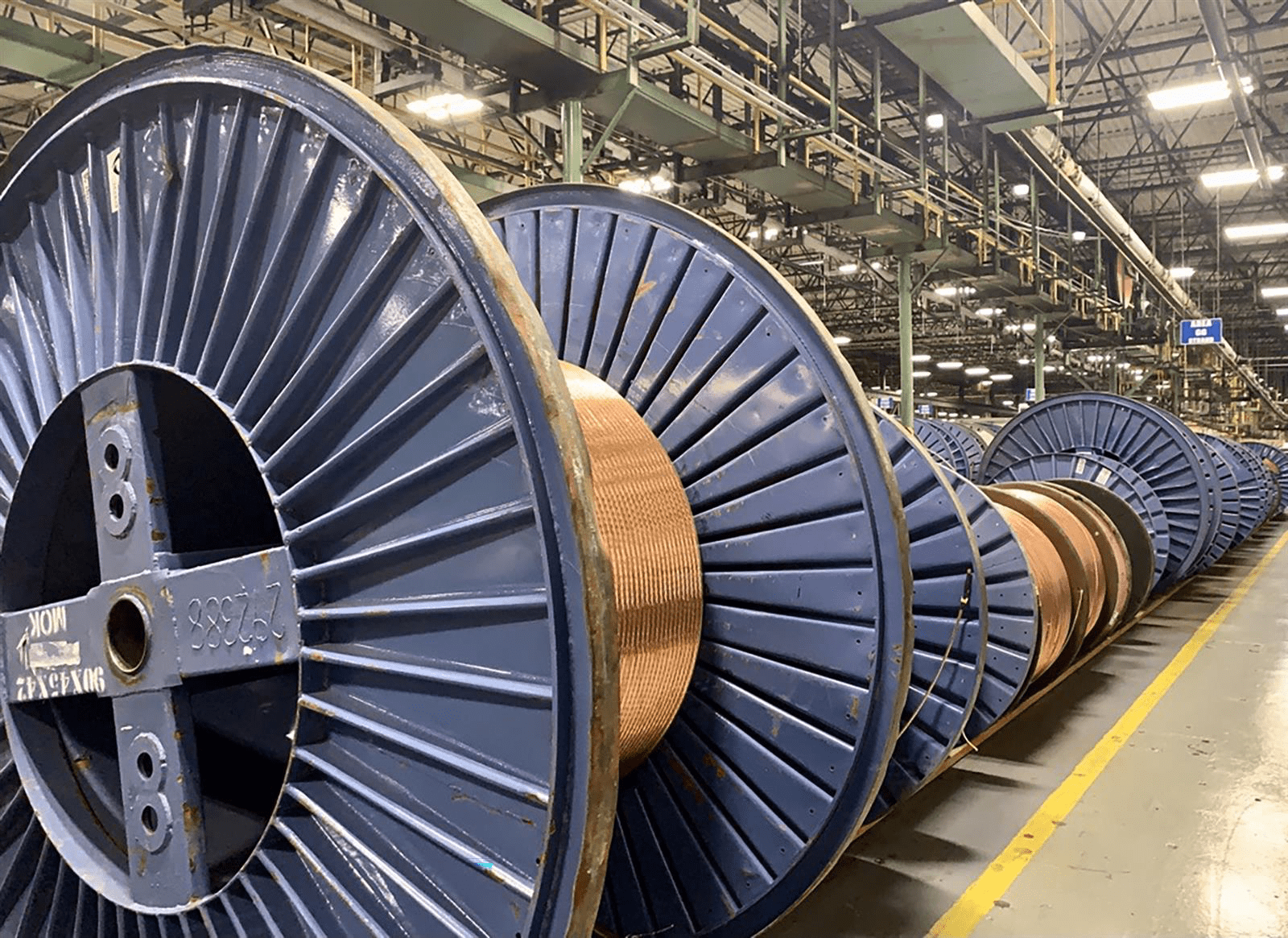

The Prysmian Group plant in Du Quoin manufactures insulated power distribution cables that transmit energy underground and inside factories. (Capitol News Illinois photo by Molly Parker)

Gov. JB Pritzker takes questions at a Prysmian Group manufacturing facility in Du Quoin on Thursday. The company will receive approximately $17.7 million in tax incentives from a state grant program as a result of its $64 million expansion that will lead to 80 new jobs at its Du Quoin plant. (Capitol News Illinois photo by Molly Parker)

3 downstate companies have signed contracts to receive tax credits, create and maintain jobs

By JERRY NOWICKI

& MOLLY PARKER

Capitol News Illinois

news@capitolnewsillinois.com

Gov. JB Pritzker announced another milestone Thursday in his administration’s push to expand the state’s role as a manufacturing hub in the renewable energy economy.

At a groundbreaking ceremony at a Prysmian Group manufacturing plant in Du Quoin, the administration announced the signing of the state’s third contract under a tax incentive program for renewable industries that initially became law in 2021.

Prysmian, which Pritzker described as “the largest cable manufacturer in the world,” produces cables and other products used in energy storage and distribution, renewable energy and electric vehicle charging stations. At the Du Quoin plant in southern Illinois, the company makes insulated power distribution cables that transmit energy underground and inside factories. Some of those cables feed power to companies that generate wind and solar energy, said plant manager Erik Perks.

With the help of an estimated $17.7 million in state tax credits, the Du Quoin site will expand by 100,000 square feet and add 80 new jobs, bringing the workforce to approximately 300.

“This expansion is on a scale of investment that Du Quoin has not seen in a generation,” Mayor Josh Downs said at a Thursday news conference. “So today I will take great pride in the fact that this announcement has very likely secured the economic stability of our city for the next 50-plus years.”

The Du Quoin plant was built in 1965 and is the largest employer in the town of 5,800 people, according to Downs. Located between Carbondale and Mount Vernon, Du Quoin was historically a thriving coal mining and railroad town, though it has seen steady population losses over the past century, like much of the region. It is best known today for the Du Quoin State Fairgrounds built atop reclaimed mine land and the prestigious horse races that it has brought to town.

Previously known as General Cable, the facility was acquired by Prysmian in 2018. Most workers at the plant are part of the Teamsters Local 50 union, officials noted.

The Italian company has its global headquarters in Milan and North American headquarters in Highland Heights, Kentucky. It plans a near-$64 million investment at its Du Quoin facility, one of its 28 plants located in North America.

“We had alternatives, but the government, the territory helped us … to make the decision to put the money here,” Prysmian CEO Andrea Pirondini said of investing in the Du Quoin plant.

The incentives will come through the Reimagining Energy and Vehicles Act, a tax incentive program that passed the General Assembly nearly unanimously in November 2021.

All three of the contracts the REV Act has yielded thus far have been with downstate Illinois companies. In September 2022, T/CCI Manufacturing in Decatur announced a plan to retool its Macon County plant to manufacture compressors for electric vehicles. Under the contract, the company was expected to create 50 new jobs and maintain 103 positions in order to receive $2.2 million in tax incentives.

In May, the state signed a contract with Manner Polymers, providing about $4.6 million in incentives to the company that planned to build a new factory in Mount Vernon that would create 60 jobs. That company manufactures PVC compounds, including some used in electric vehicles.

The REV Act was initially passed in the wake of the governor’s marquee energy grid decarbonization policy, the Climate and Equitable Jobs Act. Its intention was to lure electric vehicle and parts manufacturers to Illinois to help the state reach its goal of putting 1 million EVs on state roads by 2030.

The initial tax credits ranged from 75 percent to 100 percent of income tax withheld for newly created jobs and 25 percent to 50 percent for retained employees, depending on factors such as company location and the number of employees hired. A 10 percent credit for training expenses is also available.

The REV Act has been expanded multiple times since its initial passage to offer incentives to smaller manufacturers, double the length of benefits and increase available credit values for companies in underserved communities.

In February, Pritzker signed a law expanding the EV-focused tax credit to “other products essential to the growth of the renewable energy sector.”

“The incentives that we provide now – new incentives that didn’t exist before I came into office – are important in their thinking,” Pritzker said of companies’ decisions to relocate to or expand in Illinois. “We’re competing against other states – Texas and Michigan and Mississippi and all over the country.”

Pritzker said his administration often spends “weeks or months” talking to businesses to try to lure them to Illinois. Earlier this month, he led a trade mission to the United Kingdom, where he and 41 other state government and business officials spent much of their time promoting Illinois’ electric vehicle industry and its renewable energy initiatives.

“I don’t want to give away too much – those are taxpayer dollars, we’ve got to be careful with them,” Pritzker said Thursday. “But at the same time, when you put all those features together, and our transportation system, our ability to ship product all over the world from here, it’s quite attractive.”

Capitol News Illinois is a nonprofit, nonpartisan news service covering state government. It is distributed to hundreds of print and broadcast outlets statewide. It is funded primarily by the Illinois Press Foundation and the Robert R. McCormick Foundation, along with major contributions from the Illinois Broadcasters Foundation and Southern Illinois Editorial Association.